Wow, this report is late. But, as the saying goes, better late than never. I’ve had an expensive month in March and April and that may be part of the reason I was not excited to write this report. It’s also the reason I’m not excited to write the next month’s report. But whether good or bad, profit or loss, my goal is to be fully transparent. Hopefully, my experience will give you a realistic idea of what it’s like to run a vacation rental. But just know this is one person’s personal perspective and another person might have different results. In any case, let’s see how my vacation rental property did in March 2023.

Vacation Rental Profit/Loss

March is the start of what can be considered the shoulder of the season. It’s not quite as busy as May, June and July, but neither is it as slow as December, January or February. Sometimes snowbirds request to rent the entire month of March. As a practical matter, I go no more than the first 15 days.

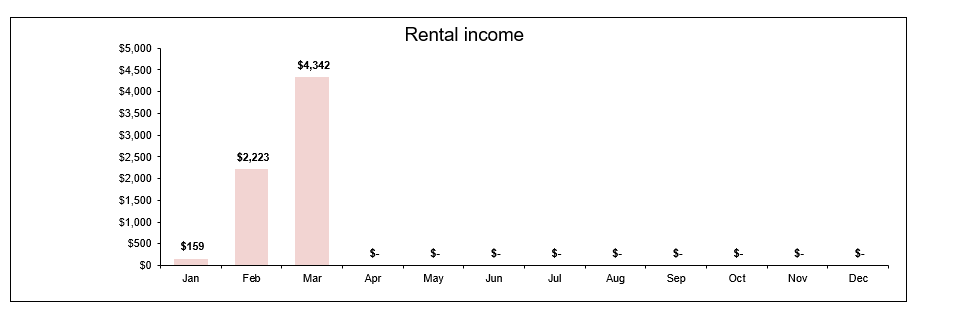

A. Vacation Rental Income

During the month of March, I earned $4,342 in income broken down as follows:

Not bad. This amount is more than I can charge snowbirds for the entire month, which is why I don’t do it. But around $4,000 is typical for the month of March.

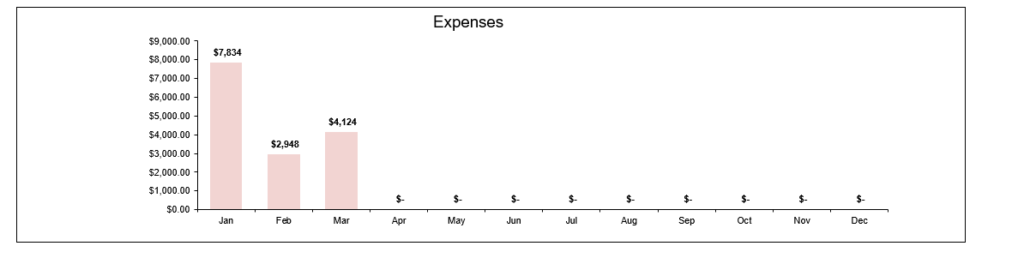

B. Vacation Rental Expenses

During the month of March, I incurred $4,124 in expenses, broken down below:

My expenses were elevated in March, as compared to last year. I had increased management costs, mostly due to preventative maintenance work on the unit. For example, I got a voluntary inspection done to see what in the unit needs improvement. I also inspected my HVAC system and had to replace the whole unit – a $7000+ cost that will be spread out over the next several months. So yea, I am not looking forward to April expenses.

C. Profit/Loss Statement

Based on the fact that my income exceeded my expenses, my profit for March was a WHOPPING $218. I know that’s small, but at this point, I will take a profit over a loss any month of the year.

Annual Income and Expenses

2022 was my first year when my condo was live on the market, so let’s see how March 2023 stacks up against March 2023.

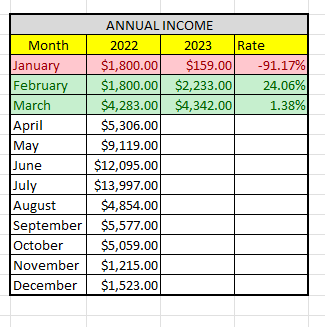

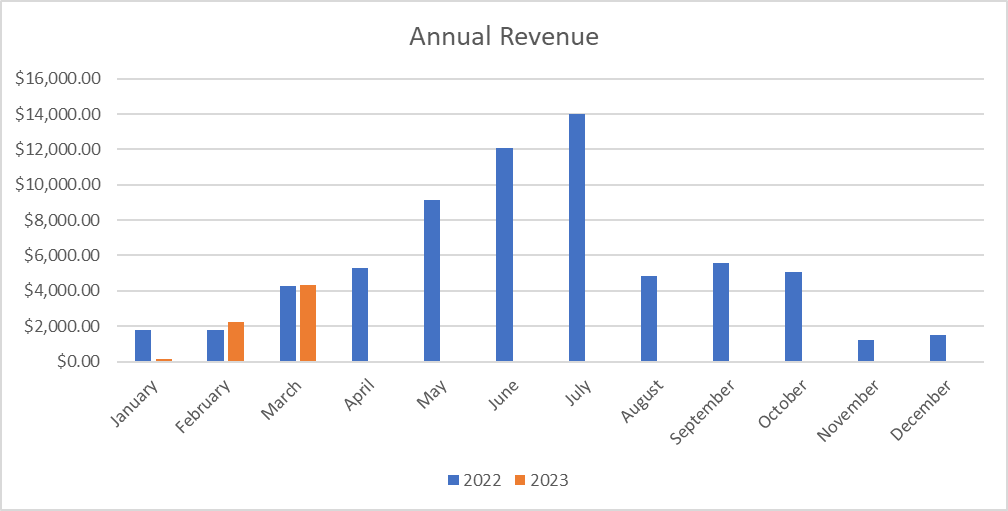

A. Annual Income

Here is the raw data:

As you can see, I incurred a 1.38% INCREASE in revenue in March 2023 as compared to March 2022. I’ll take it!

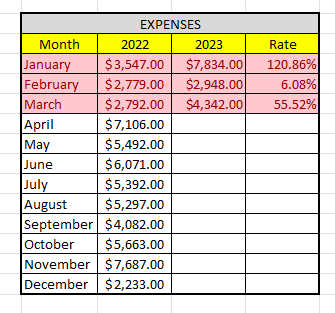

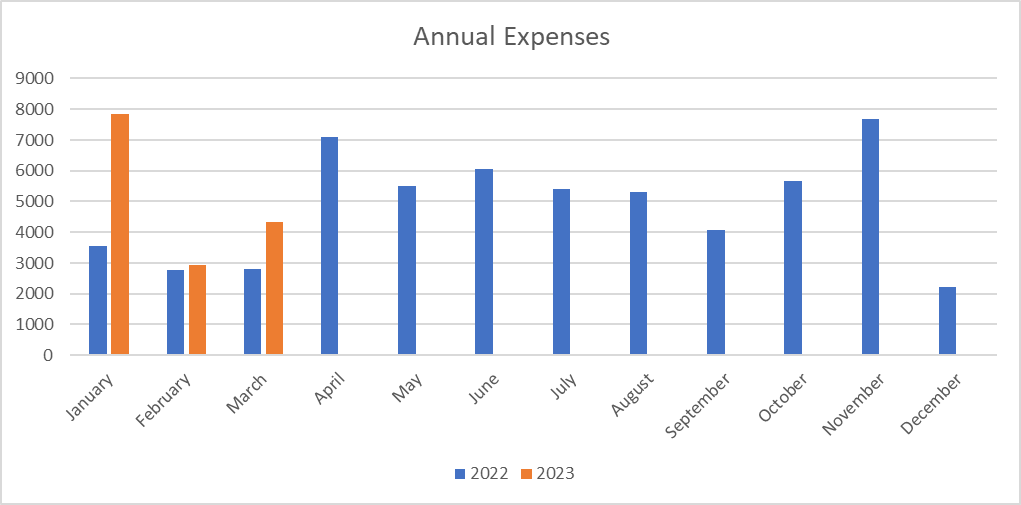

B. Annual Expenses

Here is the raw data:

As you can see, I incurred a 55.52% INCREASE in expenses this year as compared to last year. However, I think the preventative measures I’ve taken will reduce my overall expenses in the future. As the saying goes, prevention is better than the cure.

Final Thoughts

Because I was able to purchase my second beach condo in April, I have to decide how I am going to do my vacation rental reports. I am leaning towards doing a separate report for each property. That way, I don’t have a super long blog post every time. But we will see.

As of right now, I am just thankful I was able to generate a profit in March this year, even though I recognize that I had increased expenses compared to last year. I anticipate that I am going to have a lot of write-offs come tax time in 2024.

What did you think of this post? Let me know your thoughts by commenting below.