It’s December and I couldn’t be happier. In fact, I can’t wait for 2024 to get here. So, this is the second-to-last monthly report that I will be writing. This has been an expensive year and I have little to no income coming in. I am hoping that next year will be better. As I’ve indicated in numerous posts, the next six months are going to be tough. But, there is light at the end of this very dark tunnel six months from now. Until then, I can take comfort in the fact that my dividends are coming in and I get to experience dividend growth investing. However, since my portfolio is small, the growth itself is also small in the beginning. But, it is what it is. So, without further adieu, let’s see how much dividends I earned in November 2023.

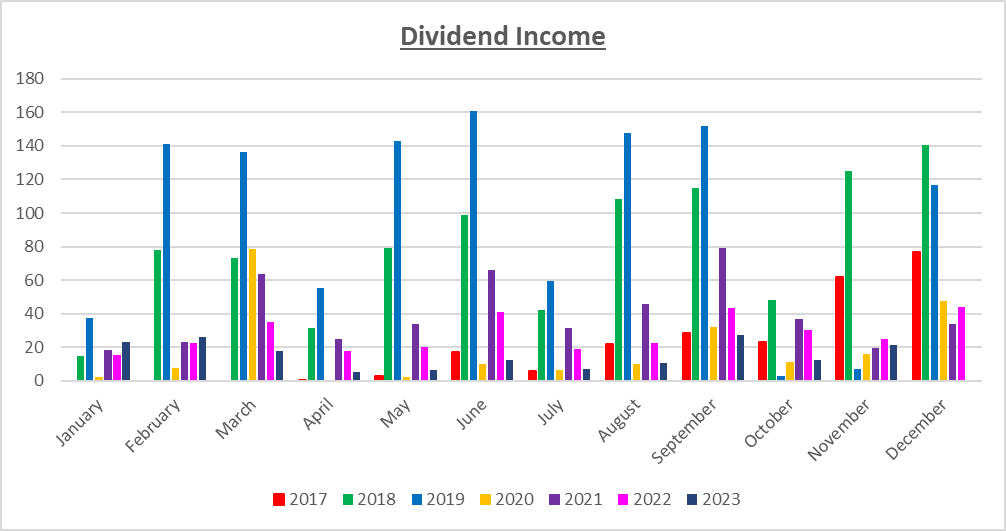

Dividend Income

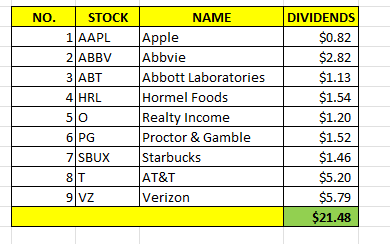

In November, I earned $21.48 in dividends broken down as follows:

$21.48 in dividends is not bad. My portfolio is small and subsequently, the dividends earned are small. But, that $21.48 went back into my portfolio to purchase more shares. That will help me get compounding growth, which is one of the benefits of dividend growth investing.

Annual Income

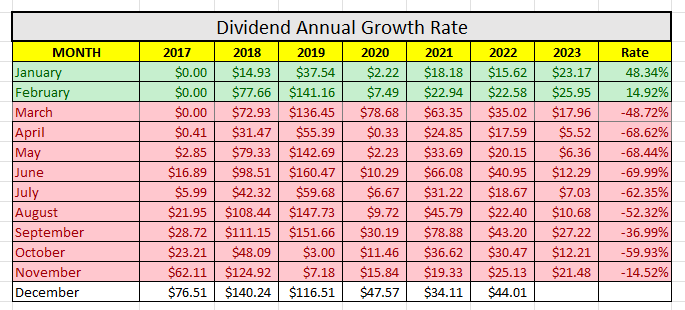

Here is the raw data:

As you can see, I earned 14.52% LESS dividends this year compared to last year. It’s going to take several more months, but I anticipate being in positive territory sometime in the future. It’s going to take consistency and discipline but I have no doubt that I’ll get there.

Forward Annual Dividends

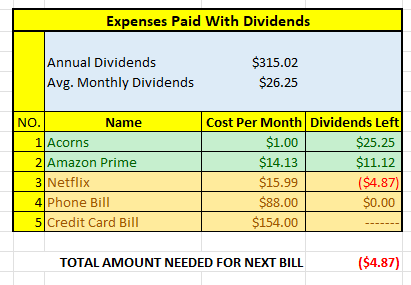

At the time of this writing, the forward annual dividends is $315.02. A month ago, my forward annual dividends was $303.61. This represents a 3.76% increase from the previous month. This small increase is mainly due to my reduced contribution to my dividend portfolio. Unfortunately, given my negative cashflow situation and my current lack of adequate income, I think the growth rate will be this low over the course of the next six months.

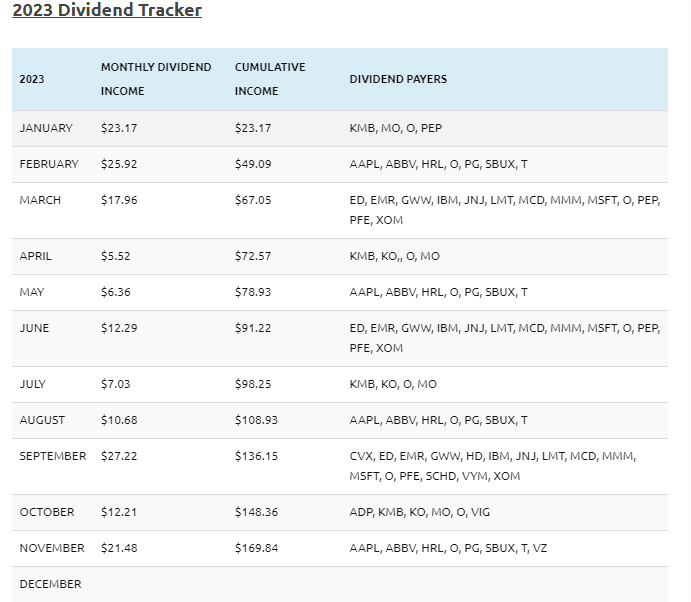

Finally, the Dividend Tracker, has been updated. As you can see from the tracker below, I’ve made $169.84 in dividends since the beginning of the year.

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$315.02 per year is $26.25 dividends per month, on average. At present, I earn enough in dividends to cover Acorns and Amazon Prime. I’ll take it. Next on the list is Netflix!!!

Final Thoughts

The dividends were small this month and they likely will remain so for the next six months. I am hoping by May 2024, I will be out of the financial pit I’ve been in. Also, my entire savings, including my emergency funds will be depleted in December. I’ll write more on this when I submit my monthly vacation rental reports. I am trying to make it to January 1, 2024 before I start liquidating assets to cover mandatory expenses.

It makes a LOT of sense for me to tap into my dividend portfolio before tapping into the last remaining funds in my retirement accounts. However, I’ve stated numerous times that I don’t plan on liquidating my stocks in my dividend portfolio anytime soon and I am going to try to stick to that plan. Based on my relatively poor health conditions, having a retirement portfolio doesn’t make sense anymore. This blog, however, is far more valuable to me than my retirement accounts.

I am currently unemployed and getting a job would alleviate all of my financial stress almost overnight. Again, I will write about this more in a later post but sufficed to say that I’ve applied for a job and I am just waiting to hear back. It could take weeks or maybe a month or two. Although I am competitive and have a good chance of getting it, there are other very qualified candidates and I am not going to count my chickens before they hatch.

Long story short, I am trying to make it to the end of the year. 2023 has been difficult and I am hoping 2024 will be better. So stay tuned.

What did you think of this post? Let me know your thoughts by commenting below.