Another month has gone by and so now it’s time for me to write the debt payoff report for October. Over the next six months, I anticipate being in a world of financial hurt. My debt will be high and my income sources will be limited. So, there will be a great struggle to pay down my debt without incurring new debt. But, as the saying goes, where there’s a will, there’s a way. In this report, I will discuss not only the current status of my debt, but my success or failure in sticking to a cash budget! So, without further adieu, let’s see how much debt I was able to pay down in October 2023.

Debt Payoff Progress

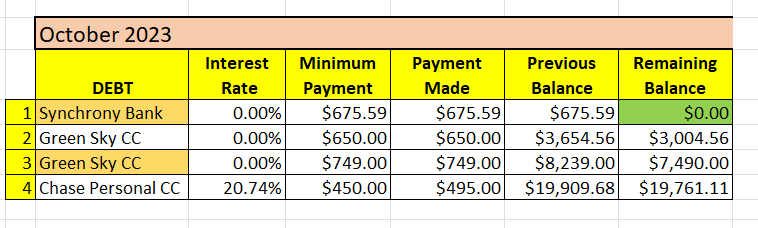

Here is the current status of my debts:

With the above report, there are some good news and bad news.

A. Good News

First the good news. As you can see from my first debt, which is Synchrony Bank, I made my last payment of $675.59. That brought my balance down to ZERO!!! So that debt is gone! Its no more! Never to return!

The reason why Synchrony Bank and Green Sky CC (#3) are highlighted is because those accounts are paid from the same business checking account. If I use a modified version of the debt snowball method, I would take the minimum payment I was making on Synchrony Bank (technically $750) and apply it to the minimum payment I am making to the Green Sky CC. So, in essence, the Green Sky CC in #3 would have a minimum payment of $1499. That would allow me to clear that debt off in a WHOPPING 5 months, as opposed to the 12 months it would otherwise take.

You’ll notice that I reference a modified debt snowball strategy. That’s because the Green Sky CC (#2) is paid from a separate business account and I don’t want to co-mingle funds. Technically, I could withdraw money from one business account to a personal account, and then transfer that money from the personal to the other business account, but I don’t want to have to do that every month. I did the math and if I did this, it would save me a few days.

That being said, because neither condo will be generating enough income on its own, I have to contribute funds to each condo from my personal account anyway. So, it may make sense to do the debt snowball strategy after all without any modifications. In future posts, I will let you know which strategy I decide to use.

B. Bad News

Now comes the bad news. My Chase personal credit card is still high and I hardly made a dent in my monthly balance. I basically just paid interest for the month.

I have limited income and cash to use and so I have to decide which of my debts are a priority. In other words, I don’t have the funds to do it all, and so I have to pick and choose. As I’ve mentioned in other posts, I’m going to be in a world of financial hurt over the next sixth months. Not being able to make a significant dent in my chase personal credit card is evidence that the hurt has started.

But, where there’s a will there’s a way. I am committed to getting through the next six months and being in a more stable financial position.

Cash Only Budget

In my last debt payoff report, I indicated that I was going to use an only cash budget. In fact, I was committed to not using my credit card for everyday purchases. Additionally, I committed to the fact that $19,909.08 was the highest I would ever let my credit card debt rise to!

I am happy to report that I’ve largely stuck to my cash only budget. Also, my Chase credit card debt is not higher than the $19,909.08 figure.

In all honesty, I did use my credit card a couple of times (literally about 2-3 times). But, I immediately paid that money back and more. I chose to pay more because I want it to hurt. It was punishment for me using my credit card. So, I am pretty pleased with this progress.

I will have a HUGE temptation on Black Friday. Specifically, I am in need of a new laptop (for many more reasons than one). I don’t have the cash necessarily to purchase it outright and I don’t want to put it on my credit card. So, something will have to give. One thing I am actively thinking about is to start cashing out on some of my investments. I was hoping to do that in January 2024, so I wouldn’t have to worry about the tax consequences for 2023, but I may not be able to wait that long. I will let you know what happens.

6-Month Relief

Honestly, it would really help if I didn’t implement my modified debt snowball strategy as mentioned above. I simply don’t have the funds. But, if I can manage to do that, I would be able to breath a HUGE sigh of relief six months from now.

So, in essence, I would tread water with my Chase personal credit card, and then focus on paying off the Green Sky CC (#3). The Green Sky CC (#2) would naturally be paid off by then and I would only be focused on paying off the personal credit card. I am seriously leaning towards this debt payoff strategy, but I fully realize it’s going to be tough.

Employment Prospects Update

I indicated in my last debt payoff report that I was selected for an interview for a dream job of mine. However, I also made it clear that I wasn’t planning on this happening. Moreso, my plans as detailed above do not depend on me getting that job. I will re-iterate that I hope for the best but will plan for the worst.

Since my last post, I did undergo the interview. I didn’t think it went spectacularly well, but I am happy to report that I was selected for a second round of interviews. Sufficed to say that I am beyond excited. I’ve been told that I have competed against hundreds of applicants and it’s even just an honor to be selected for a interview. I wholeheartedly agree. However, as the saying goes, I am not counting my chickens before they hatch. I will make sure I am amply prepared for the next round of interviews and I will let the chips fall where they may.

My financial struggles would essentially be over if I get the job, but that’s still a big if, so wish me luck. I will let you know what happens in my next debt payoff report.

Final Thoughts

The struggle is real. I am looking at cashing out my non-retirement stock accounts to get me through the next couple of months. There is not much in those accounts, and at best it may give me two months of reprieve. Don’t worry, I won’t be touching the funds in my dividend portfolio. I was hoping I will start generating revenue in two months, but that creates another problem.

Typically when a booking comes in, I will get paid before the guests arrive. I don’t want to be in a situation where I am using money for tomorrow’s booking to pay for today’s debt. My preference is to have enough in reserves where I won’t have to worry about it.

I am really hoping to get my dream job. It would solve all my financial problems almost overnight. I wouldn’t have to worry about the negative cash flow from my properties. In fact, I would have more than enough to cover those expenses and still live a comfortable life. I’ll just be working all the time – but it’s what I would be signing up for and it’s what I really want!

But, time will tell. Whether it’s good news or bad, I will be totally transparent.

Happy Holidays.

What did you think of this post? Let me know your thoughts by commenting below.