It’s November and so it’s time to publish the Dividend Income Report for October. I for one am glad that the year is coming to a close. It’s been a very expensive year so far. In fact, overall, the year has brought more negatives than positives. In looking towards the next two months, I don’t think I have many good news to report. So, it’s just a matter of waiting to see how badly I’m going to end the year. But, it’s not all negative. Despite everything else going on in my life, I can count on my dividends working for me in the background. I know my portfolio is small, but that’s ok. We all have to start from somewhere. I am living on a tight budget right now, but I am absolutely committed to not selling any more shares in my dividend portfolio. You can read all about my current financial struggles by reviewing any of my recent vacation rental reports, or my debt payoff reports. But, that’s not why you’re here. So, without further adieu, let’s see how much dividends I earned in October 2023.

Dividend Income

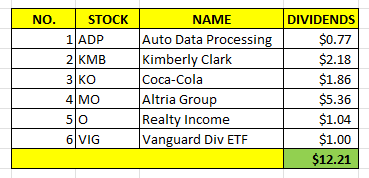

In October, I earned $12.21 in dividends broken down as follows:

$12.21 in dividends is not bad. My portfolio is small and subsequently, the dividends earned are small. But, that $12.21 went back into my portfolio to purchase more shares. That will help me get compounding growth, which is one of the benefits of dividend growth investing.

Annual Income

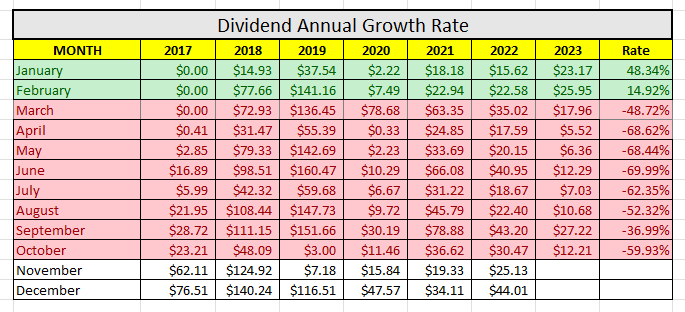

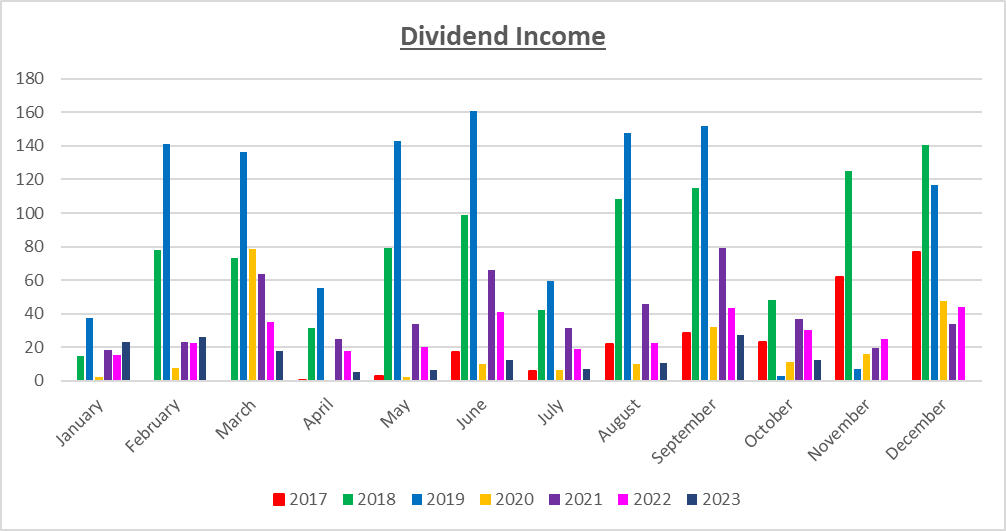

Here is a graphical representation of the dividends earned in October in relation to the dividends earned in previous years:

Here is the raw data:

As you can see, I earned 59.93% LESS dividends this year compared to last year. It’s going to take several more months, but I anticipate being in positive territory sometime in the future. It’s going to take consistency and discipline but I have no doubt that I’ll get there.

Forward Annual Dividends

At the time of this writing, the forward annual dividends is $303.61. A month ago, my forward annual dividends was $257.55. This represents a 17.88% increase from the previous month. This double-digit increase is mainly due to my increased contribution to my dividend portfolio. Unfortunately, given my negative cashflow situation and my current lack of adequate income, I don’t think I’ll be able to keep up with this level of contribution over the next six months. In fact, I’ve already lowered my my contributions to about $200 per month. I’m hoping I won’t have to lower it further, but that’s always a possibility.

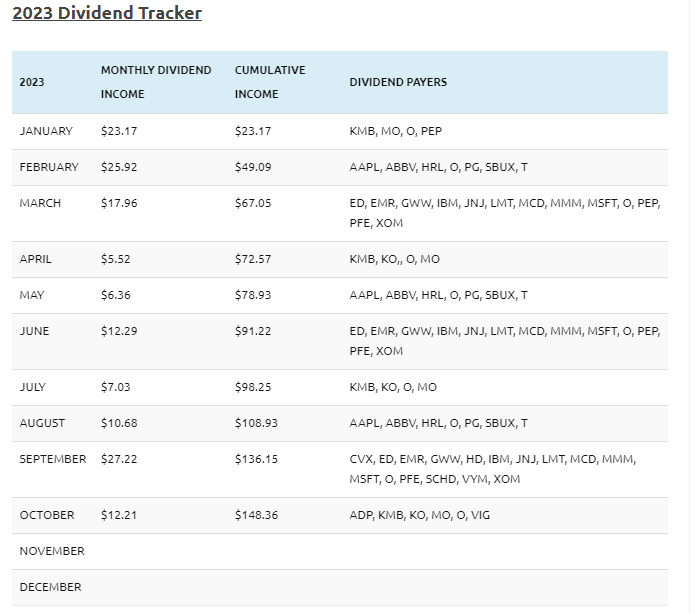

Finally, the Dividend Tracker, has been updated. As you can see from the tracker below, I’ve made $148.36 in dividends since the beginning of the year.

What Expenses Would Dividends Cover?

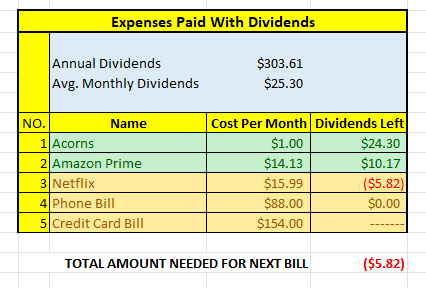

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$303.61 per year is $25.30 dividends per month, on average. At present, I earn enough in dividends to cover Acorns and Amazon Prime. I’ll take it. Next on the list is Netflix!!!

The following is a list of expenses I am targeting:

I’ll mention that the cost per month for my credit card bill is more than $154 (currently about $400). Since I’m far away from covering that amount with dividends, I won’t worry about updating this figure every month. Quite frankly, by the time I reach the point where I can payoff my credit card bill with my dividends, I will likely already have a zero credit card balance. As you may be aware, I track my credit card debt payoff on a monthly basis on this blog.

I was looking forward to covering Netflix by the first of the year. But, with the lowered amount of my contributions to my dividend portfolio, I’m not sure that will happen. We will see.

Final Thoughts

Honestly, I can’t wait for the day when I have a large portfolio so that my dividends are also large. But, I have to crawl before I can walk, and then walk before I can run. So, the next target for me is to get into triple digit territory. Of course, that seems so far away given where I am but with time, patience, consistency and discipline, I will get there one dividend at a time.

Until then, I will keep contributing to my portfolio as much as I can and continue to reinvest my dividends back into my portfolio.

Although I love dividend investing, the immediate priority for me right now is to get out of debt. My recent September 2023 Debt Payoff Report should give you a clear indication as to why it is so important for me to get out of debt. I have about $20k in credit card debt. The good news is that I have a plan to get out of debt, but it’s going to probably take me a couple of years, unless I get a job.

I am also anticipating a massive tax bill, which I haven’t really written about yet, so the struggle is real as they say. With any luck, I hopefully will be in a better financial place in about six months.

Until then, stay tuned to these monthly dividend income reports.

What did you think of this post?

Let me know your thoughts by commenting below.