Recently, I posted my September 2023 Debt Payoff Report. I hadn’t intended on posting another report for the same month, but a lot has happened since my last report that I had to just post about it. As mentioned in that last report, I had to purchase a new fence that cost me thousands of dollars. As a consequence, my credit card debt has ballooned to nearly $20,000. That’s a very psychologically depressing amount. This is especially considering the fact that earlier this year, I was able to bring my debt to about $7000. Oh well. There’s no use crying over spilt milk. So, let’s discuss where I am specifically, and what the plan is. Despite this horrible news, I will try to find some good news, but admittedly, it’s going to be hard. So, without further adieu, let’s delve into my second debt payoff report for September 2023.

Debt Payoff Progress

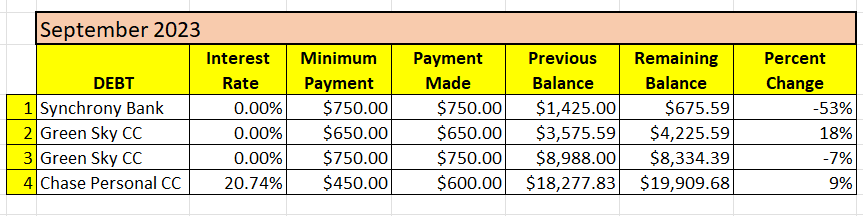

In September, here is the status of my current debts:

There are a couple of important notes.

For starters, the main category to pay attention to is the the remaining balance. You will see that my Chase credit card has jumped to a whopping $19,909.68. Mark this figure! That’s because, if I am doing this right, the balance reported in these debt payoff reports should continue to go down!!! I have put everyone in my life on notice that I am DONE spending money. The hard part is going to be my poor spending habits but I am committed.

Although $20k in debt is super high, the good news is that it’s a psychological point for me which should spark a massive change in behavior. I’ve been here before in the distant past, and so I have some success. But, it’s going to take a massive shift in my spending habit. But, I am committed to see it through.

Some of the recent increase in spending were anticipated, but not all. Life is going to suck over the next several months but there is light at the end of this financial tunnel.

More Good News

There is some more good news in the numbers. As you can see from the Synchrony Bank account, the remaining balance is $675.59. So, that account will be gone after my next monthly payment in October!

Unfortunately, I can’t just roll over that payment towards the next bill like I typically would using the debt snowball strategy. That’s because this was a business expense paid from a business account. My Chase credit card is a personal account and I like to keep my accounts separated.

If I really wanted to, I could transfer that amount from my business account to my personal account and then use that money to start paying down the debt. But, the way I like to operate is to have my business account kept totally separate so that it will pay for all business expenses. My balances are really low in ALL my accounts (both business and personal), so keeping the money in my business accounts help to rebuild my reserves.

But, I could use the debt snowball method to paydown on the first Greensky credit card balance. A close look at this balance indicates that if I maintain my current payment schedule, I should eliminate this debt in six months. This first Greensky credit card balance is associated with the same business account as Synchrony Bank. So, after November, I plan on paying a minimum of $1400 on this first Greensky credit card balance. That way, I pay it off quicker.

6-Month Relief

Life is going to be VERY ROUGH for the next six months. My most expensive condo, that costs a minimum of about $6000 per month to operate, will not be generating much income during that time. So, all the money I am getting from my pension will just be used to try to keep me afloat. In other words, there’s not much I can do about paying down my credit card debt during that time. In fact, my monthly contributions to my dividend portfolio will suffer, because right now I don’t have the extra to invest.

So, with respect to my minimum contributions, I anticipate a nominal amount for investing (about $100 per month), as opposed to the lofty current minimum of about $1000 per month. I will be modifying (and cancelling where necessary) needless expenses as well in my monthly budget.

If I can last the next six months, life will be a little bit easier. Both condos will be paying for themselves (at least over the course of several months). That will give me some breathing room to hopefully pay down more on my debt. Again, it’s going to be tough, but I’m committed.

Cash Only Budget

As I’ve sort of mentioned earlier, I am done spending money on my credit card. So, I am adopting a cash only budget for the time being. That includes shopping for Christmas.

I’ve already told my sister that I am limiting my gift shopping to about $30 per niece. So, I don’t anticipate spending more than $200 for ALL of my Christmas shopping for my family. Regardless of the amount I spend, it will be all cash.

I do travel a lot and that can be expensive as well. While I will continue to travel, I will be mindful of where I go. So, no more trips to Spain (or Europe) for now. I’ll be doing more trips where I can just drive to my condo and spend a nominal amount (all cash) while I am there. I still have a life to live and I still plan on living it.

I haven’t lived on a cash budget in a long time, but nothing changes if nothing changes. And right now, something has got to give. Wish me luck – I’m going to need it.

Employment Prospects

I recently received notification that I was selected for an interview for a dream job of mine. If I do get that job, it would almost instantly eliminate a lot of my financial concerns. Of course, it’s a very difficult job to get and even if I do get it, it won’t be for another six months.

I am operating under the notion that I won’t be getting that job. What can I say, I’m a Debbie Downer at heart. But, another way of saying it is that I like to hope for the best and plan for the worst. Maybe that’s better.

Even if I don’t get my dream job, there is always the possibility of me getting another job. That’s looking more unlikely by the day, but it’s still a possibility. Any job, no matter how small the pay would be helpful.

There are serious questions about my ability to do any job, given my health conditions, but we will see. The struggle is real as they say.

Final Thoughts

Honestly, I’ve been eager to write this report for some time. I just spent the last money of anticipated expenses on my credit card today. I was waiting to do that before writing this report.

Of course, there are always the possibility of more unexpected expenses occurring. There’s not much I can do about those. If they are truly unanticipated expenses, I may have no choice but to use the credit card. But by and large, I will not be using the credit card for everyday expenses anymore.

To quote or paraphrase Dave Ramsey, you can wander into debt but you can’t wander out. Right now I have a plan to get rid of my debt. Although this a long-term plan, it’s important to have mini-milestones along the way.

So, in my next monthly debt payoff report, I will be notifying you if I was able to stick to my cash only budget. If I am, then that will go a long way to show that I am cable of staying the course, one monthly report at a time.

What did you think of this post?

Let me know your thoughts by commenting below.