In November 2018, I reduced the contribution level to my dividend portfolio. I reasoned that such a contribution level was inconsistent with my goals of saving for a down payment to buy a house. At the time, I was correct. But since reducing the minimum contribution level to my dividend portfolio, I’ve decided that I should once again increase my contribution limit for several reasons. So what changed? Let’s explore, shall we!

1. Reduced Living Expenses

One of the major differences between November 2018 and March 2019 is that I moved locations. In doing so, I reduced my housing costs by at least $600 per month. Before, I was paying $1300 per month in rent. Now, I’m paying $700 per month in rent. That savings is huge!

But that’s not the only thing. My utilities are drastically reduced! My transportation costs are also drastically reduced! For example, I no longer pay tolls when I travel for entertainment, and I don’t have to worry about airport parking fees when I travel for work. It’s just great!

Based on where I’m living, I walk to many places to eat or for other entertainment. So, I’m really loving where I’m living at the moment.

2. Wasting Too Much Money On Entertainment

I fancy myself as a smart individual. But, I have to admit that I am a creature of habit. Despite my lofty retirement goals, I still have a problem with spending money, especially if it’s in my bank account.

I Will Teach You To Be Rich by Ramit Sethi (affiliate link) is one of my favorite books on money. It’s on my resources page. In that book, Ramit talks about Conscious Spending (or guilt-free spending), which I regularly practice. I’m not a big fan of budgeting. I track my expenses virtually on a daily basis. I have a spreadsheet that I look at several times per week. So, I know exactly where my money is going and how much I am spending on eating out and on entertainment.

Knowing where my money is going is half the problem. Changing my behavior to curb that is the other half, and I’m still struggling with that department. One of the important things I realize about myself is that if money is in my account, it’s going to get spent! Period!

Disciplined Approach

But as much as how I waste a lot of money, I am also very disciplined in other ways. For example, I don’t touch money that is in a retirement account, ever! That money is there for me to use when I retire. I almost don’t consider how much money I have in that account, because I treat it as if it’s not there.

The same applies to money that is invested in the stock market. I treat this money differently as well. I view this as my taxable retirement fund and so I am a buy-and-hold type of investor. Indeed, I try never to sell if I can avoid it. I haven’t intentionally sold any of the stocks in my dividend portfolio. Recently, some shares of Realty Income were sold to accommodate a transfer from one broker to another, but that was a requirement of the broker to sell the fractional shares because only whole shares could be transferred.

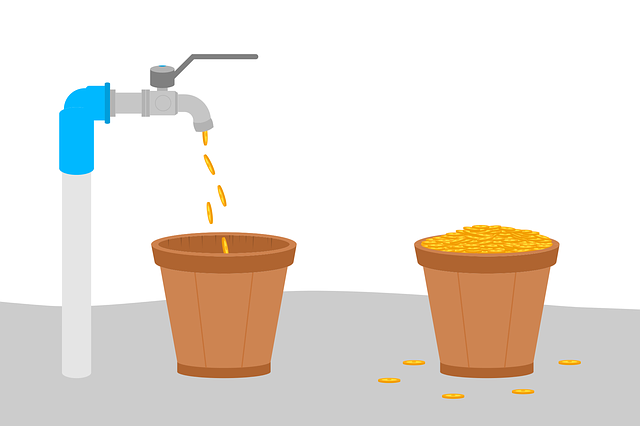

So, once money is invested, it’s not touched! By increasing the contribution limit to my dividend portfolio, I reduce the amount of cash on hand I have to spend/waste.

Increased Amount

I’ve decided to increase the minimum contribution levels to what it was prior to the reduction in November 2018. This will help my portfolio grow at a faster speed, as the total minimum contribution to the portfolio will exceed $1000 per month.

I chose this amount because it reflects the fact that I am serious about building wealth through dividend investing. I hope to never have to reduce the minimum contribution ever again. But, I also understand that life happens when you make plans. So, all I can do is make the best decision with the information I have at the time.

3. It Felt Good

Honestly, I felt as if I wasn’t doing enough when I reduced my contribution limit. I definitely want to buy a house and so it’s important to save for a down payment. Arguably, it probably would have been better to devote the increased contribution to saving to buy a house. There is value in focusing on one strategy at a time.

Take the debt snowball method as an example. That strategy suggests paying off the smallest balance first while maintaining the minimum balance on all your other debts. Then, when that debt is paid off, you focus on the next smallest balance. Brilliant! There is power in focus. That’s probably a better strategy than paying an increased amount on all your debts at once. You’ll eventually get there, but only if you maintain the will-power to keep going.

By trying to save for a down payment on a house AND invest, I dilute the amount of money that can be geared towards one goal vs another. But, I feel it’s very important to invest now so that I get the benefit of compounding dividends. It’s a tough decision, but I’m ok with that balanced approach.

4. The Struggle Is Real

It’s going to be tight every month trying to make ends meet. Because of overspending, I usually have too much month left after I spend my money. By increasing the contribution limit to where it once was, I fully expect to keep struggling every month. The difference, however, is that now I will be struggling because most of my money is going towards my investments (and saving for a down payment) and not towards eating out and entertainment.

The struggle is real!

Saving For A Down Payment

It’s important to note that my goal of saving for a down-payment will remain the same. Currently, I have saved only a small amount towards my down payment. I plan on saving $1500 per month and fully expect to have enough of

By saving and investing aggressively, I’ll be doing a lot with the little money I bring in per month. I firmly believe that saving and investing and engaging in guilt-free spending

Conclusion

In November, I did something I thought I would never do. I reduced the contribution limit to my dividend portfolio. Specifically,

Now, after evaluating my financial situation again, I feel that the best thing for me to do is increase my contribution limit to the level it once was before I made the reduction. This, of course, will be in addition to saving for a down payment on a house.

Do you think I made the right decision? What would you do? Let me know your thoughts by commenting below.

I think it’s great that you’re ramping up the monthly contributions again. At the end of the day, if you’re meeting your savings goals I don’t think there’s anything wrong with spending on whatever. It’s important to balance saving for tomorrow with living for today.

DivvyDad recently posted…Dividend Income Report :: February 2019

I constantly struggle with finding that balance. Who says I can’t enjoy my way to retirement?

Fantastic, sounds like that move was well worth it. Imagine what an extra $600+ a month can do to your portfolio. Well done mate.

Buy, Hold Long recently posted…4 Day Work Week

Thanks BHL. It’s very long term before I see the benefits of the compounding but fortunately, I’m in no rush.

Nice increasing your contributions DP! Good job in reducing your living expenses. When I moved, lower living expenses was the major goal I was aiming for. That allowed me to save and make more stock purchases. And you are also still saving for a down payment on a house. I probably couldn’t do both, I would have to lower my contributions to my portfolio considerably if I was aiming for a house in the near future. I think you made the right call! 🙂

My Dividend Dynasty recently posted…February 2019 Dividend Income

Yea, being able to do both is amazing (if I can pull it off). Then, after I buy the house, I’m going to have to decide what to do with that extra $1500 per month. I will either save to buy another house or put it in my dividend portfolio. Decisions, decisions.

Pingback: Dividend Income Report - March 2019 - Dividend Portfolio

Pingback: Dividend Income Report - April 2019 - Dividend Portfolio