Welcome to the first vacation rental report for Calypso Memories for 2024. 2023 ended with a resounding loss for the year and so I’m excited to get it over with. I’m more optimistic for 2024. Specifically, there’s a chance I might end the year with a profit. Or, at the very least, I’ll likely end the year with less of a loss than that I did in 2023. My goal for this year is to keep my expenses to a minimum. So, time will tell. But, for now, let’s see whether I made a profit or loss for my vacation rental in January 2024.

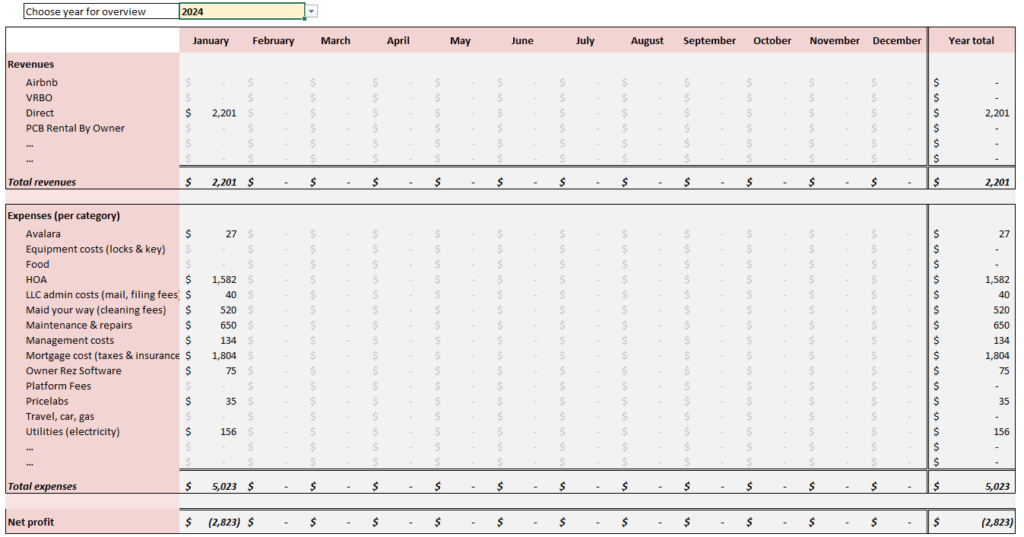

Vacation Rental Profit/Loss

Let’s see whether I made a profit or incurred a loss in January 2024 at Calypso Memories.

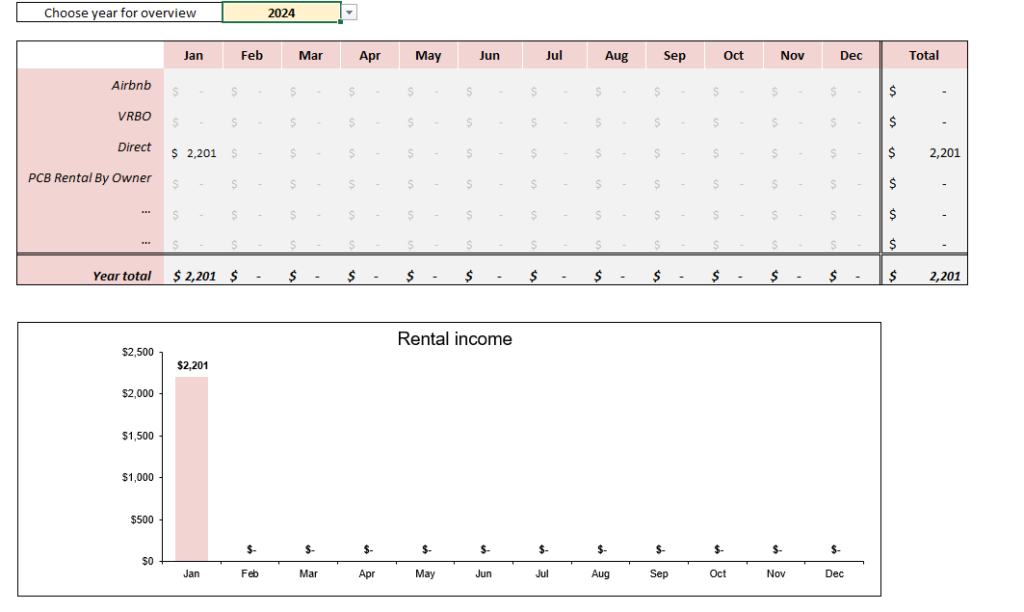

A. Vacation Rental Income

During the month of January, I earned $2201 in income broken down as follows:

This $2201 amount reflects the rate I charge snowbirds for this property. Thankfully, because my debt service is relatively low, compared to my other condo, the amount I earn at least covers the mortgage, taxes and insurance, but that’s about it.

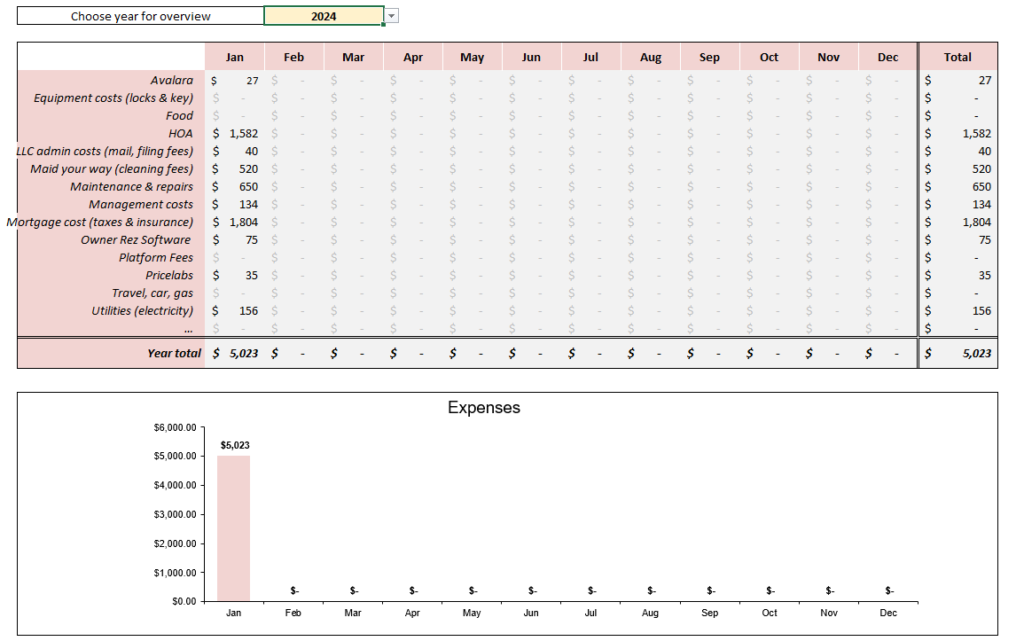

B. Vacation Rental Expenses

During the month of January, I incurred $5023 in expenses broken down as follows:

Wow! $5023 is a lot of expenses, especially for a guy who says he wants to keep expenses low. So, a bit of explanation is in order.

The expenses were high because for starters, I pay my HOA quarterly. So, I had to pay my HOA in January. In addition, I still have my HVAC ($650) that I am paying for. I have about 1 or 2 more months of payments left. So, that, coupled with my regular mortgage payment ($1804) and other routine costs brought the total up that high.

For what it’s worth, I do expect February’s expenses to be slightly elevated because one of the costs I pay for are seasonal beach chair services for my guests. That’s a one-time cost for the year. In future months, I expect other one-time advertisement costs for the condo. But again, I don’t expect anything as huge as another HVAC purchase expense.

C. Profit/Loss Statement

Based on the fact that my expenses exceeded my income, my loss for January was $2823.

As shown below, my year-to-date loss is $2823. This gets updated every month.

Obviously, I am starting the year at a loss. But, I am still optimistic for the future.

For February, my income will remain the same because I still have snowbirds for that month. But starting in March, I hope to start making more than $2200 a month. The busy season starts in March, but really, more like April and definitely May. I can’t wait.

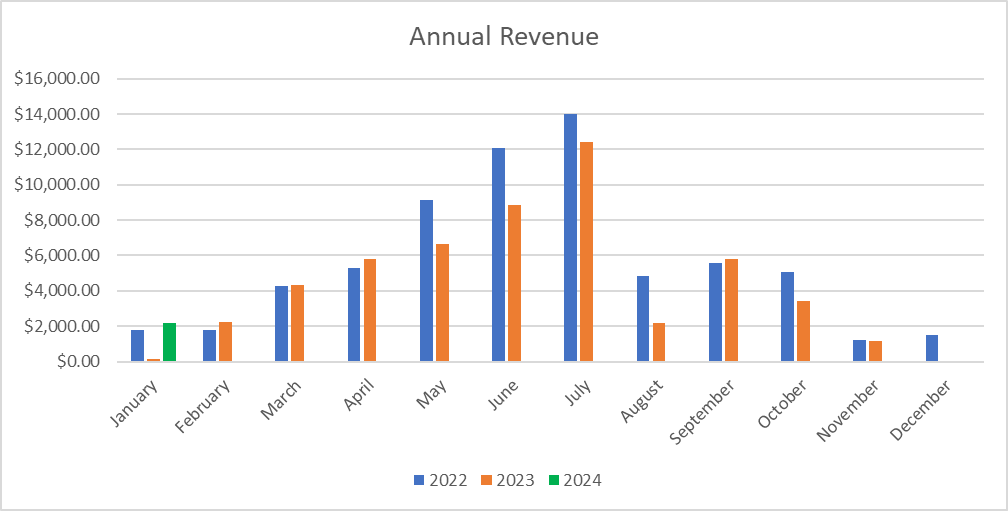

Annual Income/Expenses

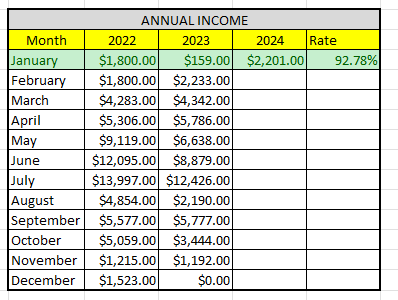

Let’s see how January 2024 at Calypso Memories stacks up against January 2023.

Here is the raw data:

Nice! If you look carefully, I’ve earned more this January than I have the previous 2 Januarys. It’s a bit refreshing to see some good news, even though I’m at a loss for the month. My income is trending upwards which is what I like to see.

Of course, in looking to February, I will earn exactly $2201 again for the month, so that will be less than last year February, but oh well.

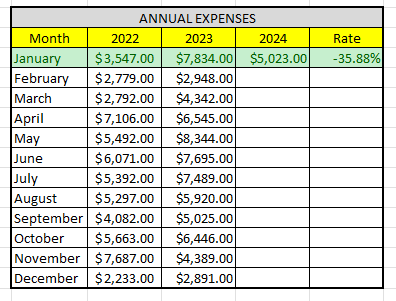

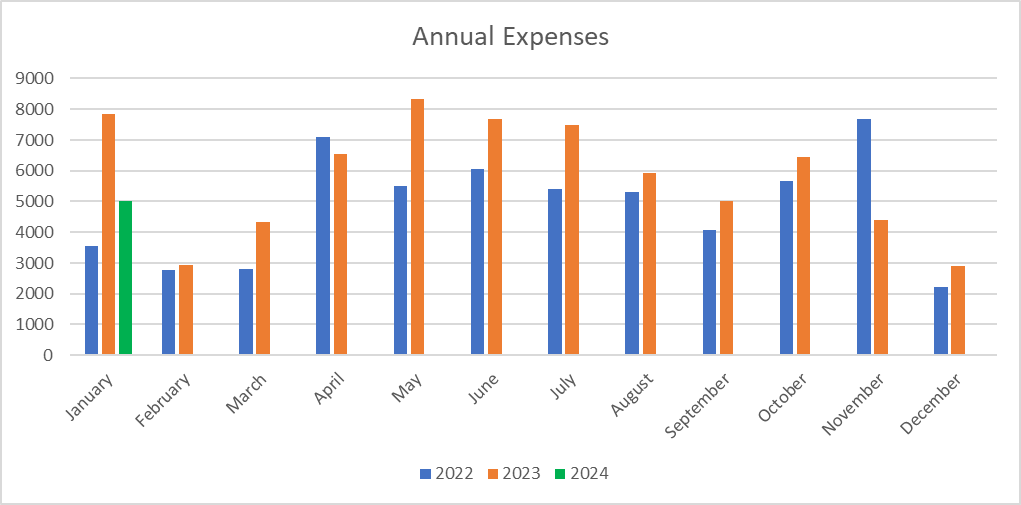

B. Annual Expenses

Let’s see how the annual expenses at Calypso Memories look from 2024 to 2023.

Here is the raw data:

Another round of good news. My expenses this year were 35.88% LESS than my expenses last year! I’ll take it. I’m hoping the trend continues for the remainder of the year.

Final Thoughts

This was a mixed report in terms of good news and bad news. The bad news is that I am starting the year off at a loss, which is of course prime importance. The good news is that my annual income and expenses are off to a good start. We will see what the rest of the year bring, but as always, I am optimistic.

It really helps that the debt service on this property is relatively low. Unlike my other condo, I have a reasonable chance every year of ending in a profit or incurring a small loss. Last year was of course the exception. With my other unit, I will likely have to support the condo with my personal funds until interest rates come down low enough that it makes sense for me to refinance. But, that’s a post for another day.

What did you think of this post?

Let me know your thoughts by commenting below.