Welcome to the first dividend income report for 2024. I’m excited for the new year and really hope 2024 is much better than 2023. With a new year comes resolutions and new motivations to fulfill your goals. Dividend Growth Investing is a long slow process. But, if one can stick with it for the long term, it would be well worth it. It’s one way to experience compounding growth! Sure, things are slow at first, but they become incredibly larger at the end of the snowball. So, without further adieu, let’s see how much dividends I earned in January 2024.

Dividend Income

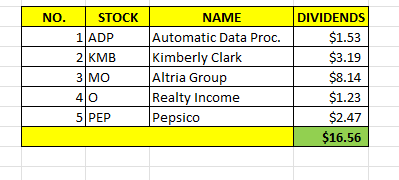

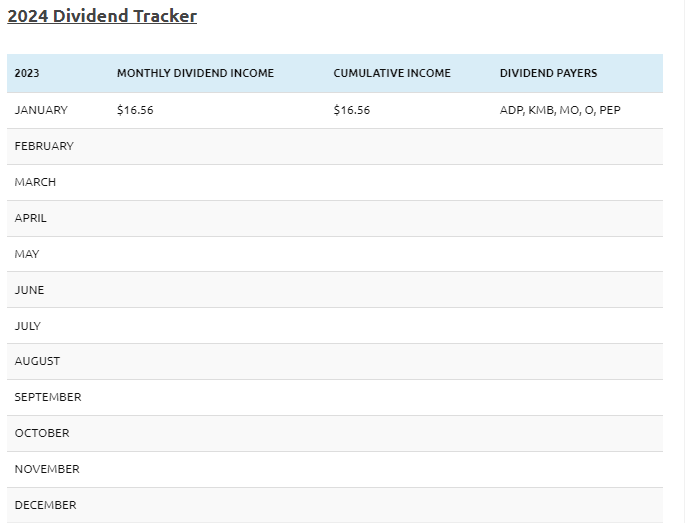

In January, I earned $16.56 in income broken down as follows:

That’s a small amount. But, my portfolio is small. Dividend Growth Investing is a long-term strategy and that $16.56 was re-invested back into my portfolio. Hopefully, towards the end of the year, I will be able to increase my monthly contribution to my portfolio but all in good time.

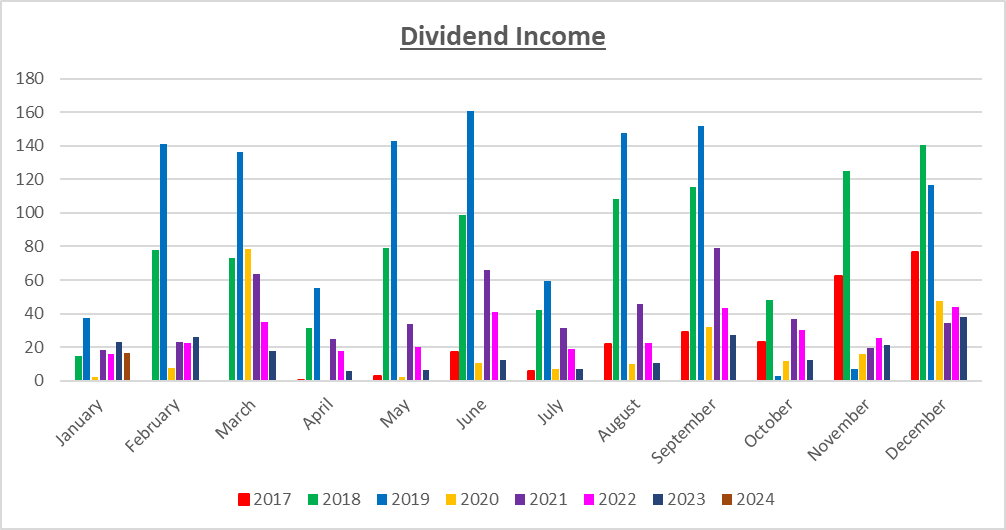

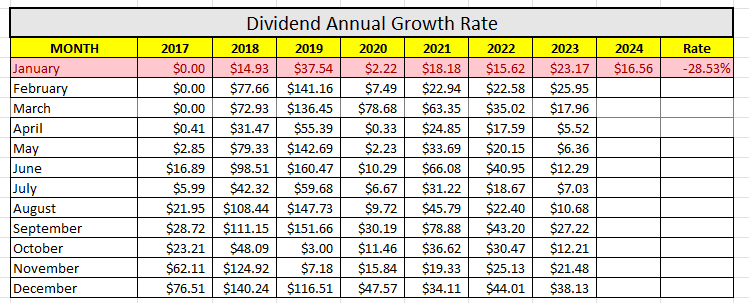

Annual Income

Here is the raw data:

As you can see, I earned 28.53% LESS dividends this year compared to last year. I feel fairly confident that I’ll be in positive territory come January 2025, but time will tell.

Forward Annual Dividends

At the time of this writing, the forward annual dividends is $336.92. A month ago, my forward annual dividends was $327.96. This represents a 2.73% increase from the previous month. This small increase is mainly due to my reduced contribution to my dividend portfolio. Unfortunately, given my negative cashflow situation and my current lack of adequate income, I think the growth rate will be this low over the course of the next five months.

Finally, the Dividend Tracker, has been updated. As you can see from the tracker below, I’ve made $16.56 in dividends since the beginning of the year.

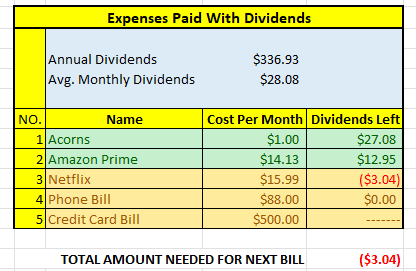

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$336.92 per year is $28.08 dividends per month, on average. At present, I earn enough in dividends to cover Acorns and Amazon Prime. I’ll take it. Next on the list is Netflix!!!

Final Thoughts

I am excited to see what 2024 has to offer. My dividends will be small for the first half of the year and maybe even be small all year round. But that’s ok. It’s a marathon and not a sprint.

2023 sucked, but it’s all behind me. So, I’m hoping to get back to a disciplined approach to my finances including dividend investing. Of course, I have my priorities straight. I have about $20,000 in credit card debt. To follow my journey, check out my debt payoff journey that I disclose on a monthly basis. In the mean time, I will continue to invest a small amount of money every month in my dividend portfolio. After I get out of credit card debt, I’ll be able to invest substantially more on a monthly basis.

How was January for you?

What did you think of this post?

Let me know your thoughts by commenting below.