I am excited to write this report. July is arguably the busiest month of the year and so the income to expense ratio should squarely be in my favor. That being said, I am mindful of the notion that bookings have been down this year. Also, there are still 11 other months of the year and not all of them can be as good as July. Quite frankly, one way to look at it is that it’s all downhill from here! But, that’s next month’s problem. For now, I am hoping that this turns out to be a solid report. So, without further adieu, let’s see how Emerald’s Corner vacation rental report did for July.

Vacation Rental Profit/Loss

I am hoping for some strong numbers for July. Let’s see.

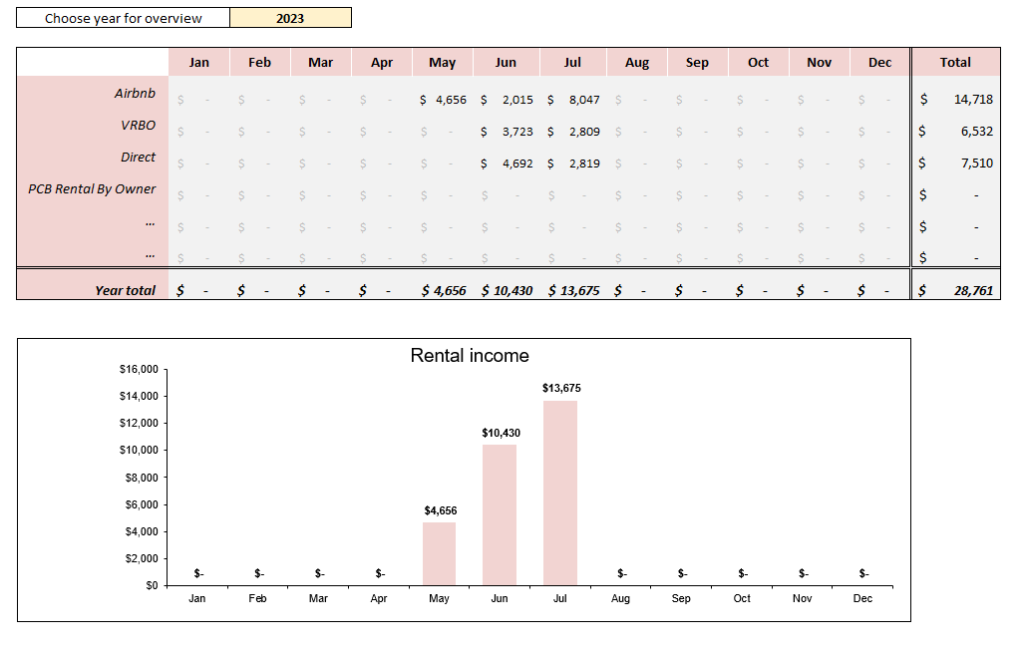

A. Vacation Rental Income

During the month of July, I earned $13675 in income broken down as follows:

This is the first July that I am reporting income and I am pleased. Moreover, because this is a new condo, I offered a lot of discounts, including for the month of July. There’s no telling what I would have made without those discounts, but I guess I will find out next year.

The last thing I’ll mention is 2021 and 2022 were crazy times for the hospitality industry. Because of COVID, a lot of Americans were stuck inside there homes. So, when things started opening back up, there was a HUGE demand as people wanted to just get out of the house.

Travel seems to be more normalized in 2023 and so, arguably, demand is even less. CNN just did an article that entitles “You are not imaging it. Everyone you know is in Europe this summer.” International travel for vacation seems to be up. And, the so call Airbnb Bust is upon us. So, I am happy that July was so strong, but I know I won’t get that every month.

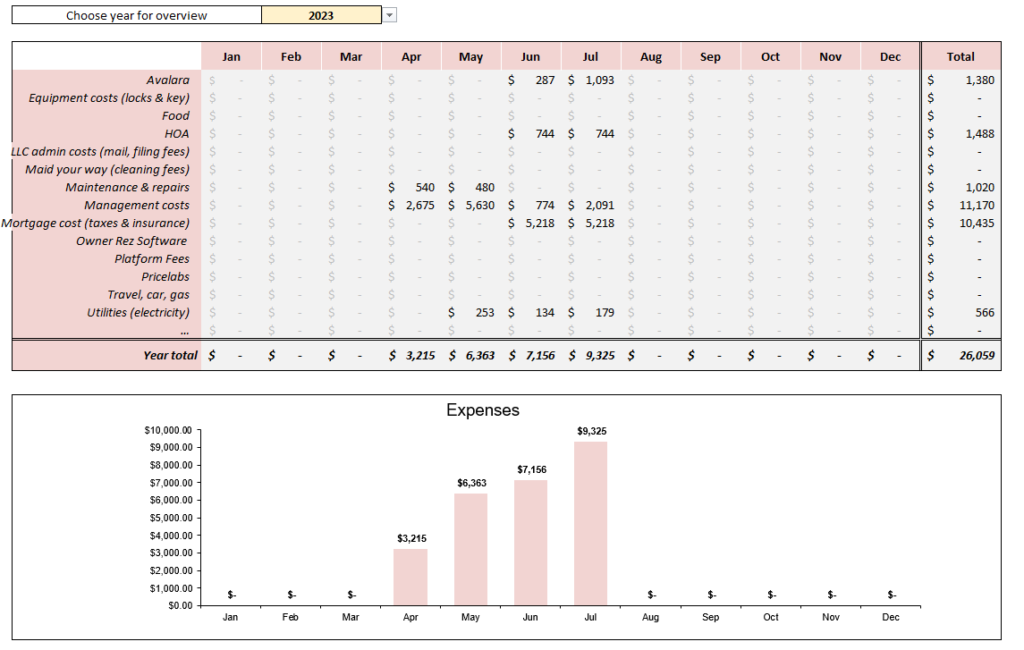

B. Vacation Rental Expenses

During the month of July, I incurred $9325 in expenses broken down as follows:

Wow, that’s a lot. Of course, this is to be expected. My expenses for this property will likely always be high for the foreseeable future – probably for the next year or two. The mortgage alone is $5218.

Also, there are no cleaning fees reflected in this report. That’s because those cleaning fees were being paid by my other unit. That being said, I am working with my cleaning crew to rectify the accounting error. I anticipate this will be resolved in a month or two (the latest).

Although bookings were great for July, they are not necessarily that great for the next few months. I am hoping things will change, but we will see.

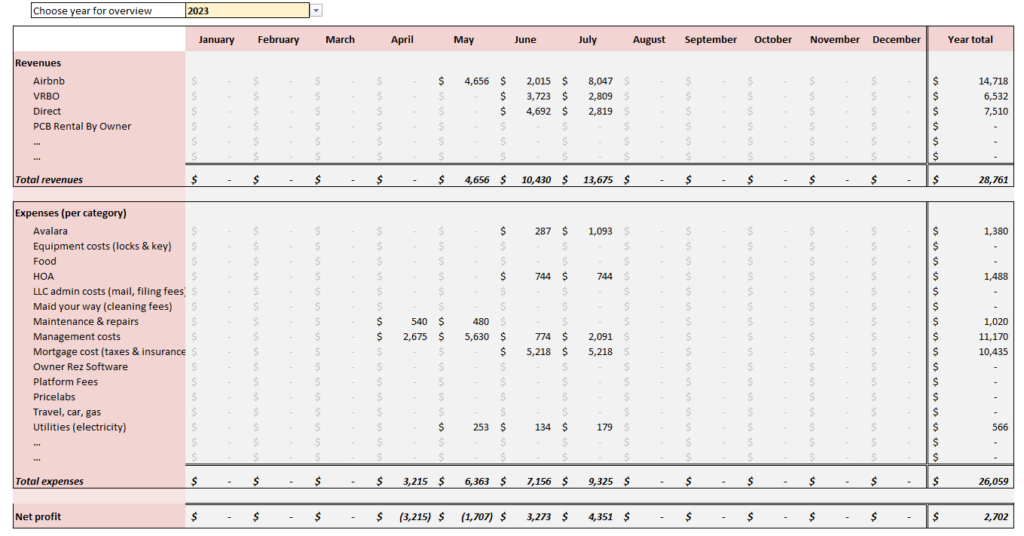

C. Profit/Loss Statement

Based on the fact that my income exceeded my expenses, my profit for July was $4351. Again, this number is a bit off because it doesn’t include the cleaning fees. But, considering all the discounts I gave in July, that’s not a bad profit. More importantly, I finally tuned a profit since I bought the property in April. it helps to put a dent in the loss I’ve experienced since I bought the property in April.

So, as shown below, even with a slow down in bookings, I am very happy with my year-to-date profit of $2702:

Although I am glad that my unit is profitable, I know that there are going to be tough times ahead. It’s very difficult to make enough money per month to even cover just the mortgage. Also, I am expecting elevated expenses in August because of electrical expenses that I chose to incur. In looking ahead, I anticipate elevated expenses in October because of plumbing expenses I chose to incur. The point is I would rather do preventive maintenance than trying to fix a problem when it arise. As the saying goes, “prevention is better than the cure.”

Annual Income and Expenses

This is my first year owning Emerald’s Corner. So, I don’t have any income or expenses to compare it to. This section will make a lot more sense come July 2024.

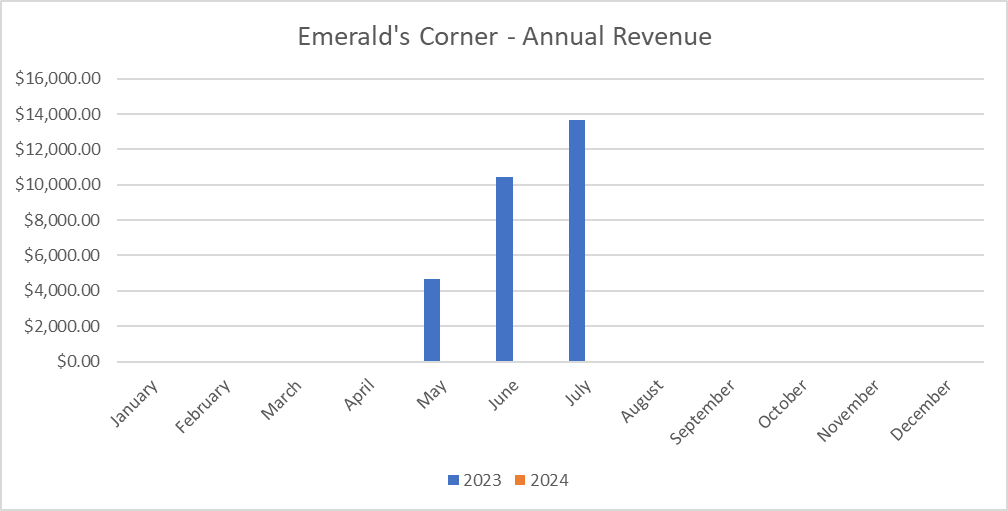

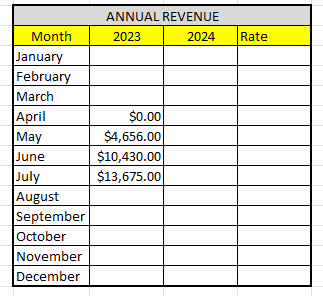

A. Annual Rental Income

Here is the raw data:

Hopefully, the revenue will continue to be strong over the next several months.

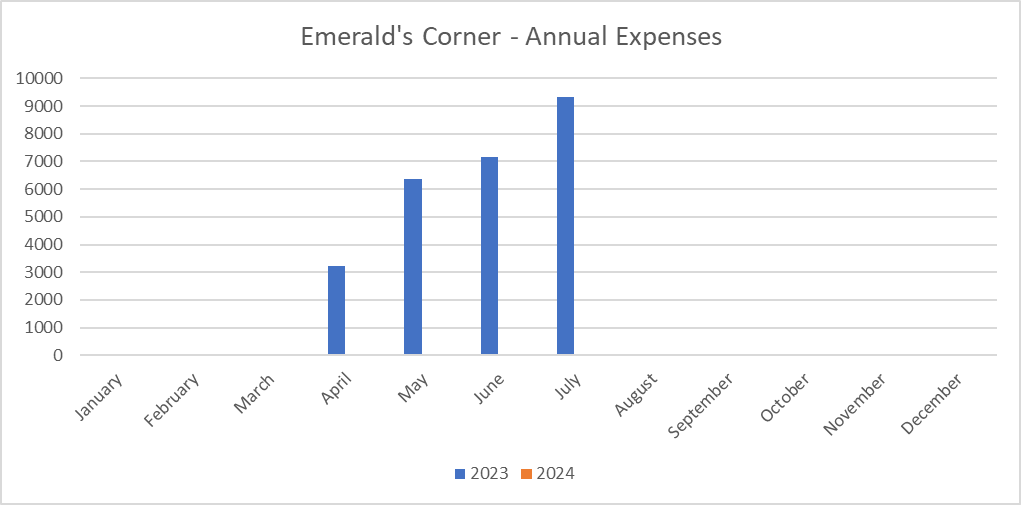

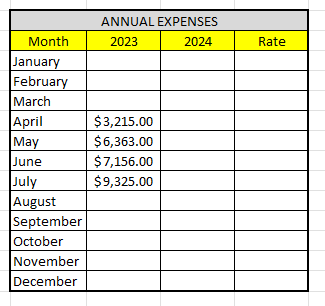

B. Annual Expenses

Here is the raw data:

I’m glad I had a profitable month. But again, this section will make a lot of sense in 2024 when I am able to make an annual comparison.

Final Thoughts

This was a great report and it marked a turning point for the property in terms of profits. But, I am afraid this might be short lived. I anticipate I will have elevated expenses in August and again in October, coupled with lower bookings. To that extent, I don’t expect that the rental income will cover all my expenses over the course of the next several months.

What’s more is that while I do have snowbirds for the winter months, the monthly rent doesn’t even cover half of the mortgage payment! So, the struggle is real.

I am definitely feeling the effects of the Airbnb bust at this property – at least when I look ahead at my calendar and the low rental rates of the bookings that I do have. But, I plan on taking things one month at a time and I hope that I can weather the financial storm until I am able to refinance in about a year or two from now.

What did you think of this post?

Let me know your thoughts by commenting below.