Recently, I wrote a very dismal vacation rental report for Calypso Memories. Now it’s time for me to write the vacation rental report for Emerald’s Corner. Although I wish I had good news to report, the fact of the matter is that I don’t. So, I anticipate this is also going to be a tough report to write, given how expensive this year has been. Neither condo is operating where it is sustaining itself. As a result, I have to contribute money from my personal account to both condos to keep them afloat. The problem is that with no job, that’s a very difficult task to do. But, as always, I promise transparency and to report both the good and the bad of my vacation rental income and expenses. So, without further adieu, let’s see how Emerald’s Corner did in October 2023.

Vacation Rental Profit/Loss

Let’s see whether I made a profit or incurred a loss in October 2023 at Emerald’s Corner.

A. Vacation Rental Income

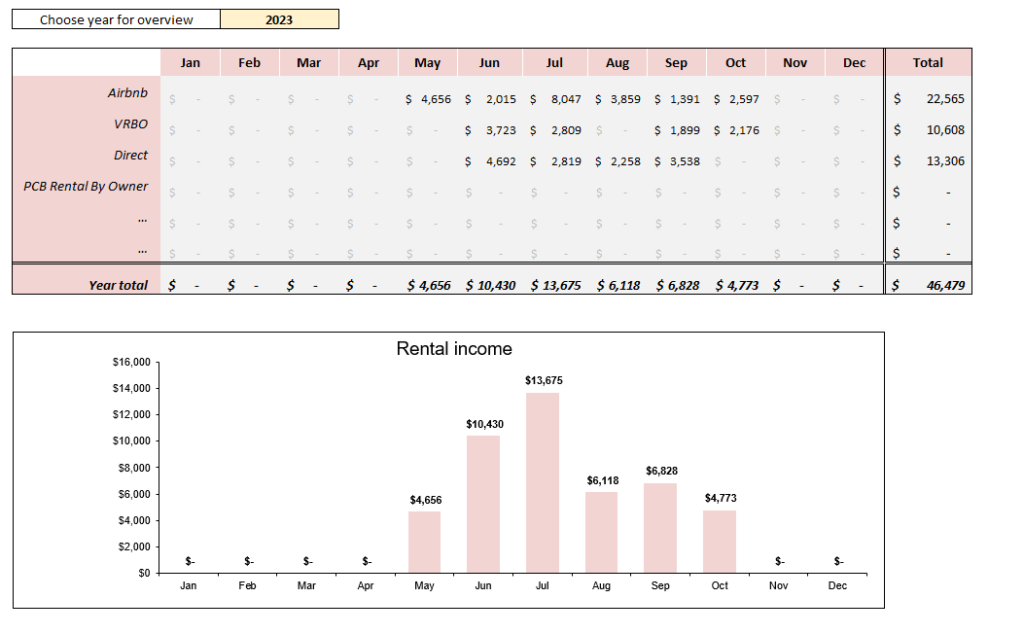

During the month of October, I earned $4773 in income broken down as follows:

This amount is relatively low and it doesn’t even cover the debt service on the property, which is about $6000 a month. Granted, we are heading into the slow season and so this is to be expected, but it doesn’t make it any easier.

B. Vacation Rental Expenses

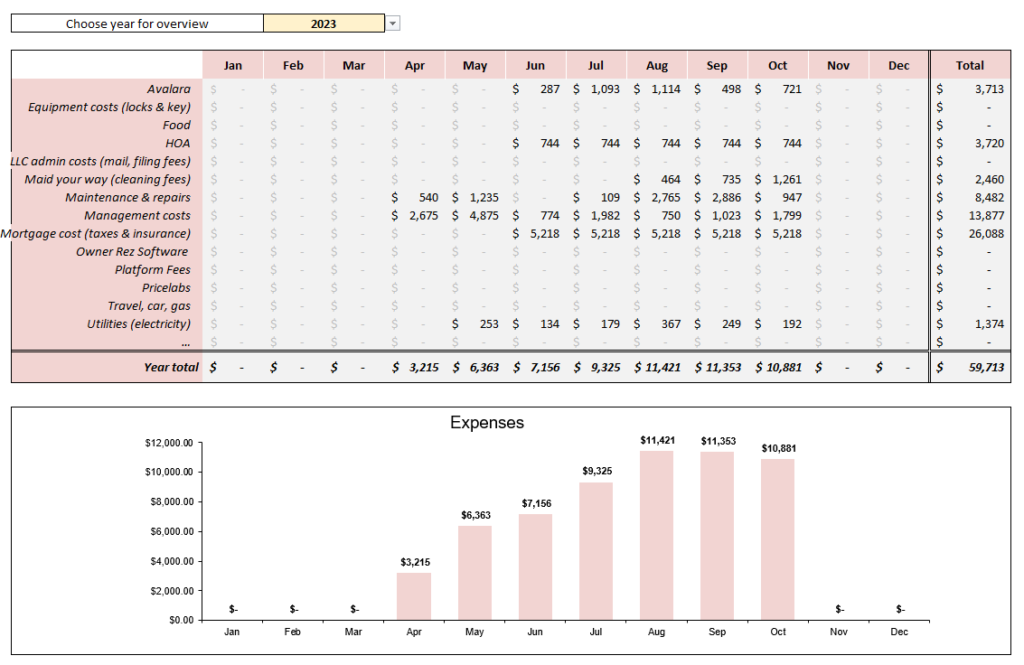

During the month of October, I incurred $10881 in expenses broken down as follows:

One of these days, I am just hoping for my expenses to be under $10,000 a month! Anyway, my elevated expenses had to do with some preventative maintenance that I did on the property.

The good news is that I have a plan to payoff my debt fully before any interest is applied. Once this debt is paid off, I am hoping that my expenses will be under $10,000 a month.

Additionally, come December when my snowbirds are in the property, I am also hoping that the expenses will be somewhat reduced. But, we will see.

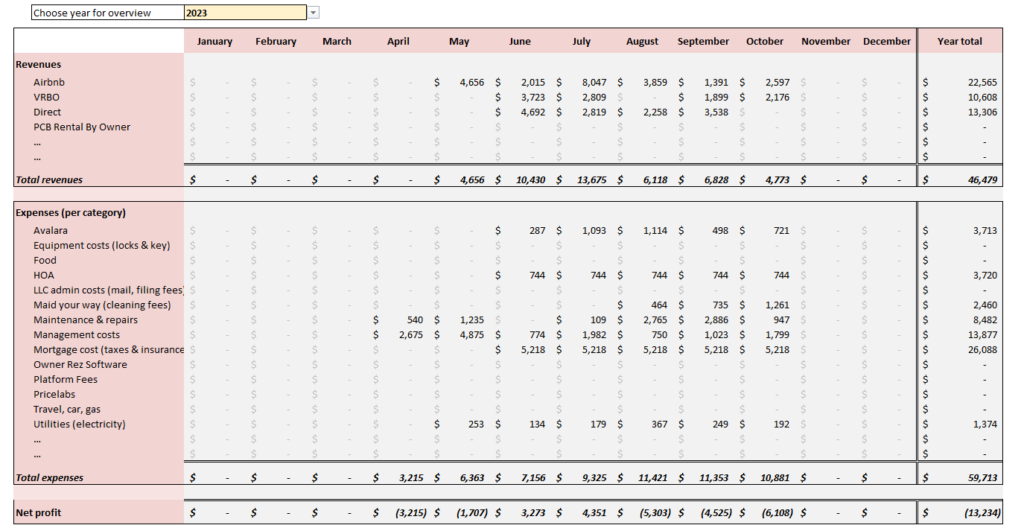

C. Profit/Loss Statement

Based on the fact that my expenses exceeded my income, my loss for October was $6108. This is a significant loss.

As shown below, my year-to-date loss has increased to a WHOPPING $13,234.

So, to understand why this is such a big deal, the year-to-date loss for Calypso Memories is $10,501. So, between both properties, my total year-to-date loss is: $23,735. When the year started, I did have some money in each condo to cover some loss, but not over $20,000 worth. That’s why I have to contribute money from my personal account to help keep the condos afloat.

Also significantly, this is only the report for October. There is still November and December to go. Right now, my calendar is TOTALLY empty for November and so I may actually have ZERO income for November, with expected expenses of at least $8,000!!! Does screaming help? AHHHHHH!!!!!! No, it did not.

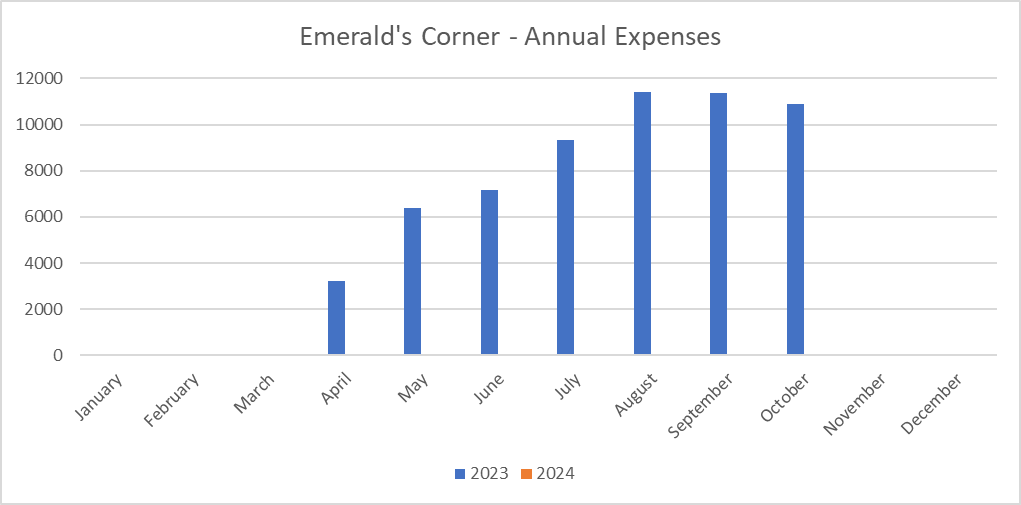

Annual Income and Expenses

This is my first year owning Emerald’s Corner. So, I don’t have any income or expenses to compare it to. This section will make a lot more sense come October 2024.

A. Annual Income

Here is the raw data:

Thankfully, the income for October was less than September. But, again, we are heading into the slow season and so this is to be expected.

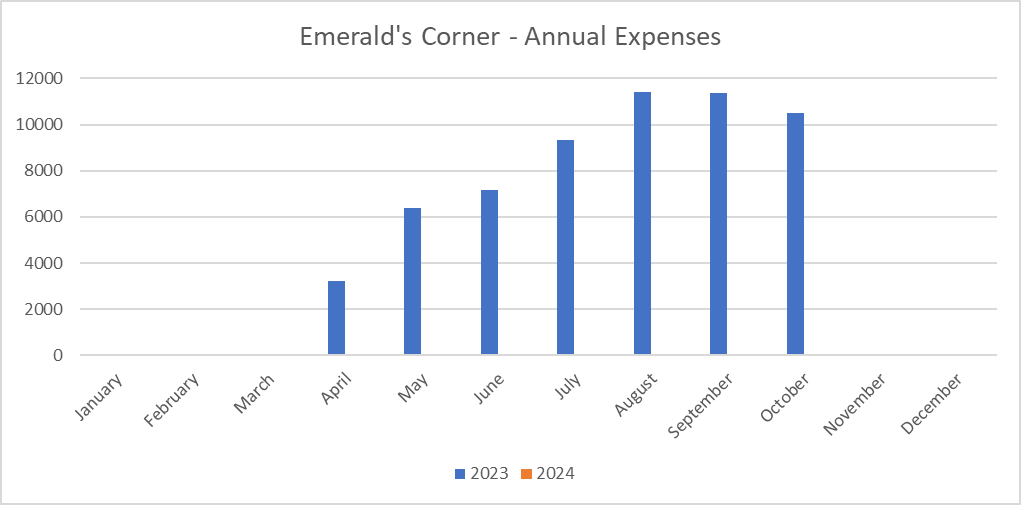

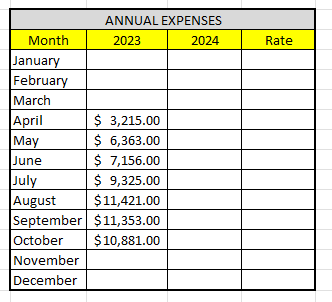

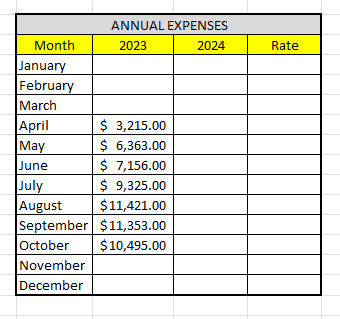

B. Annual Expenses

Here is the raw data:

Again, this section will make a lot of sense in 2024 when I am able to make an annual comparison.

Final Thoughts

I can’t wait for the year to be over. It’s been crazy expensive, and we still have two months to go. I expect November to be brutal because I will likely have zero income and all the expenses. Moreover, the Airbnb bust is real and I’m feeling it.

Actually, I just realize that technically, I will receive income for November, but that amount of money will cover December, January, February and half-of-March. Put another way, although I will have money to pay for November’s bills, I will absolutely have ZERO income for December, January, February and half-of-March!!! As a reminder, just to cover the debt on the property (mortgage, taxes, insurance and HOA fee) is about $6000 per month. There are other typical administrative expenses that I incur per month. So, let’s call that $7000. That’s the amount of money I have to come up with from December to March to keep THIS condo afloat. Although I get money from a pension, it’s not $7000 a month!

I do have money in my emergency fund that will likely help me for one month. I could sell stocks (NOT those in my dividend portfolio) to help with another month or two. It’s going to be tight, but we will see.

Finally, I am expecting a huge tax bill next year. I am hoping that the massive loss in my condo will help reduce my tax liability – but that’s another post for another day.

In the mean time, I will be taking things one month at a time. As the saying goes, where there’s a will, there’s a way.

What did you think of this post?

Let me know your thoughts by commenting below.

Property costs are brutal. I am always doing the mental math to see if places will pencil out as an investment. We rent out our house back in America and rent over in Tokyo. I feel bad that the owner must be going into the hole considering how expensive real estate is in the area. Hopefully in the end your risk will pay off!

Veronica Hanson recently posted…3 Best Hotel Chains to Earn Status

Hopefully Veronica. The good news is that I do get enjoyment from use of the property, but it is VERY expensive to maintain. In fact, I am currently at this property right now with my mom. There are only a small amount of upgrades we need to do, which basically includes updating the balcony furniture. Then it’s just a matter of maintaining what we have, as all the upgrades would have been completed. But yea, hopefully it becomes profitable in the end.