Just like that, April is behind us. Wow, what a busy month it has been!!! There were several days when I was doing like 3 jobs at a time. But it’s all good, and it’s all over! So, now I can relax. I have planned vacations to the beach. 4 beaches in fact. Over the next two months, I plan on visiting Panama City Beach, Myrtle Beach, Charleston, and beaches in Jamaica. The cool thing is that whether I am working crazy hours, or relaxing on the beach, my dividends are working for me in the background. I love the passive nature of dividend growth investing. It does take time for the dividend portfolio to grow, but the strategy is easy to understand and simple to execute. But, enough stalling. Let’s see how much dividends I earned in April 2022.

Dividend Income

In April, I earned $17.59 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | KMB | Kimberly Clark | $4.10 |

| 2 | KO | Coca Cola | $3.37 |

| 3 | MO | Altria Group | $8.37 |

| 4 | O | Realty Income | $1.75 |

| $17.59 |

$17.59 is certainly on the small side. What’s interesting is that I am writing this report while sitting at Starbucks. I almost spent that amount purchasing breakfast and coffee. So, it’s going to take a lot of patience for me to build up my dividend portfolio. Who knows – maybe quitting Starbucks will get me there faster.

Annual Income

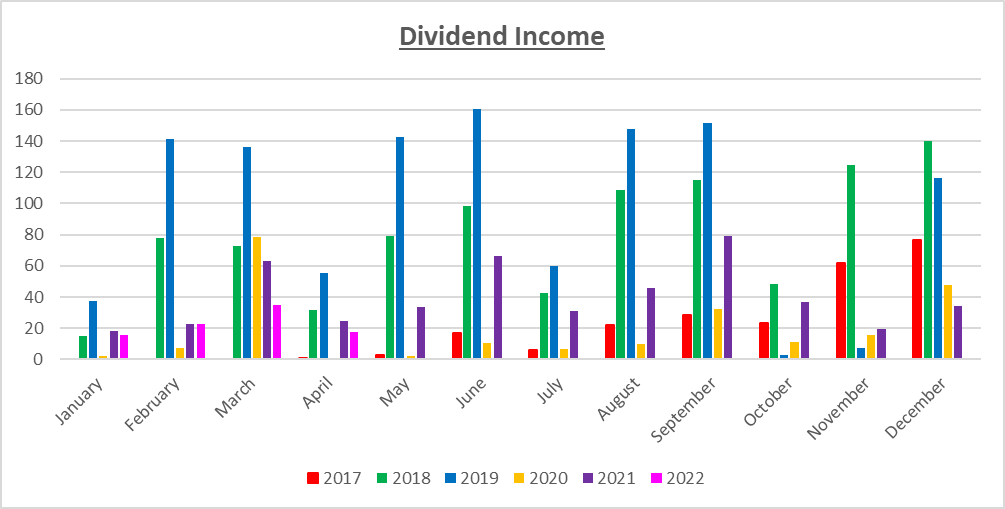

Here is a graphical representation of the dividends earned in April in relation to the dividends earned in previous years:

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | $18.18 | $15.62 | -14.08% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | $22.94 | $22.58 | -1.57% |

| March | $0.00 | $72.93 | $136.45 | $78.68 | $63.35 | $35.02 | -44.72% |

| April | $0.41 | $31.47 | $55.39 | $0.33 | $24.85 | $17.59 | -29.22% |

| May | $2.85 | $79.33 | $142.69 | $2.23 | $33.69 | ||

| June | $16.89 | $98.51 | $160.47 | $10.29 | $66.08 | ||

| July | $5.99 | $42.32 | $59.68 | $6.67 | $31.22 | ||

| August | $21.95 | $108.44 | $147.73 | $9.72 | $45.79 | ||

| September | $28.72 | $111.15 | $151.66 | $30.19 | $78.88 | ||

| October | $23.21 | $48.09 | $3.00 | $11.46 | $36.62 | ||

| November | $62.11 | $124.92 | $7.18 | $15.84 | $19.33 | ||

| December | $76.51 | $140.24 | $116.51 | $47.57 | $34.11 |

I made nearly 29% LESS in dividends this April than I did in April of last year. Not bad overall. Clearly my dividend portfolio did not move in the direction I would have hoped. But, with consistency and dedication, I fully expect April 2023 to exceed the income generated in April 2022.

Forward Annual Dividends

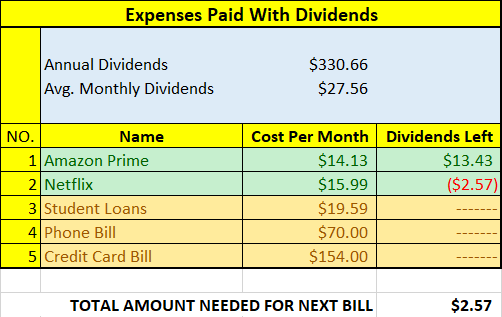

At the time of this writing, the forward annual dividends is $330.66! A month ago, my forward annual dividends was $318.45 This represents a healthy 3.83% growth from the previous month. Part of the reason for the high growth rate is because I didn’t really updated my dividend portfolio contributions in March. So I think is over a two month period. In any case, I’ll take it. Right now, I am focused on getting out of credit card debt. More on that later. Once that happens, I will concentrate on rebuilding my dividend portfolio. Wish me luck.

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$330.66 per year is $27.56 dividends per month, on average. At present, I earn enough in dividends to cover Acorns and Amazon Prime. I cancelled my Hulu Plus subscription. I hadn’t used it in months. The next bill I am targeting is Netflix. The total amount needed until I can pay the next bill is $4.58 in dividends. I hope to cover this bill during the first half of 2022.

The following is a list of expenses I am targeting:

Credit Card Balance Report

This is a new section. In my previous April payment post, I reported that my credit card balance was $7589.71.

I’ve made some payments AND purchases on card since then. At the time of this writing, my new credit card balance is $7787.43. That’s an INCREASE of $197.72. As the saying goes, the struggle is real. What’s worse is that I have my vacation coming up!!! Grrrr.

In any case, the overall goal is for me to get out of credit card debt by October of this year. That is very realistic, albeit also very difficult to do. I am not just fighting high credit card debt interest rate, but I am fighting my own behavior and attitude towards spending. Clearly I know what to do! But, actually doing it is the hard part. There’s no reason why I need to give Starbucks or the bars so much of money. I probably should also stop spending $20 at Golden Coral just to have dinner. At least I’m invested in Starbucks stock.

That being said, I hope to make another substantial dent in my overall credit card balance in a few days. Rest assured that I will post about it when I do.

Conclusion

I am very excited about the future. The hard part of my job is over with, at least for now. Next week, I’ll only have to work two days of the week. I will be able to start driving for Uber and Lyft again, although I’ll be on vacation for much of May and June – but every little bit helps.

Right now, my credit card debt is holding me back from my future goals. Afterall, debt is a thief. In addition, I keep fantasizing about cashing out my Roth IRA to purchase another beach condo! Hahahaha. Don’t worry, I’m no where close to being able to do that just yet – even if I wanted to. No bank is going to give me a loan for at least a couple of years I don’t think. But I’m gonna keep dreaming. If I am patient, I will be really ready to purchase another one in 2025. By then, my current 401k loan will be paid off, and I’ll be ready to borrow again from my 401k! But I digress.

I can’t wait to be contributing substantially to my dividend portfolio again. In the mean time, I am going to continue to work on getting my financial house in order.

In my next few posts, I will be publishing my vacation rental income report and my May credit card payment. So stay tuned.

What did you think of this post?

Let me know your thoughts by commenting below.

Oh man, 4 beaches at different 4 destinations! Your next two months sound awesome! Glad to hear your workload eased up. Got to enjoy the fruits of your labor now. Like you said, whether your working or at the beach, dividends are working for you in the background 24/7. Nice month and keep up the great work! 🙂

My Dividend Dynasty recently posted…April 2022 Dividend Income and Springtime

I can’t wait MDD. The sun, the sand, the waters – it’s going to be bliss. Definitely a much needed break from all the chaos and hard work.

Hi,

I wonder what tools you use to make these dividend/income reports?

We’re making a new tool to visualize your message about your investments.

The idea is to run a 3-min wizard by filling your stocks, your important metrics, and get a nice visualization that shows everything in one place.

You can see some examples here:

https://vyz.app

We’d be happy to get your opinion about this and whether such a tool is useful for you. As we’re building it, we’d be happy to get your feedback.

Thanks a lot!

Jim

Appreciate Jim, and good luck with the project.

I use excel and I am very used to it. It works well for me, but I realize it’s old school.

Thanks for the comment.