Oh what a month it has been. I suppose I could spend some time going over all the ups and downs of the past month. Sufficed to say that I bought a beach condo and had to sell some of my stocks. So, this is going to be a difficult report to write. However, if nothing else I am transparent. Visit my dividend portfolio page to checkout the latest status of my portfolio.

In any case, it looks like I’m still going to have to rebuild my portfolio again. The good news is that I didn’t go all the way down to zero. So, I don’t have to exactly start from scratch. And, if I were a betting man, and I am, I would say that I will be able to rebuild my portfolio quicker than I did before. But for now, lets see how much dividends I earned in September 2021.

Dividend Income

In September, I earned $78.88 in dividends broken down as follows:

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | ED | Consolidated Edison | $8.12 |

| 2 | EMR | Emerson | $3.87 |

| 3 | GWW | W.W. Grainger | $3.56 |

| 4 | IBM | Intern. Bus. Machines | $9.01 |

| 5 | JNJ | Johnson & Johnson | $5.97 |

| 6 | LMT | Lockheed Martin | $5.51 |

| 7 | MCD | McDonalds | $5.20 |

| 8 | MMM | 3M Company | $7.24 |

| 9 | MSFT | Microsoft | $1.52 |

| 10 | O | Realty Income | $3.22 |

| 11 | PEP | Pepsico | $6.66 |

| 12 | PFE | Pfizer | $7.27 |

| 13 | XOM | Exxon Mobile | $11.73 |

| $78.88 |

$78.88 is not bad for the month. It’s above the $50 mark and it gets closer to 3-digits. In any case, that’s almost $80 that I didn’t have before and that will be re-invested in my dividend portfolio. That way, I experience the power of compounding. With a small portfolio, the compounding effect is small, but over time, it grows exponentially. I can’t wait.

Annual Income

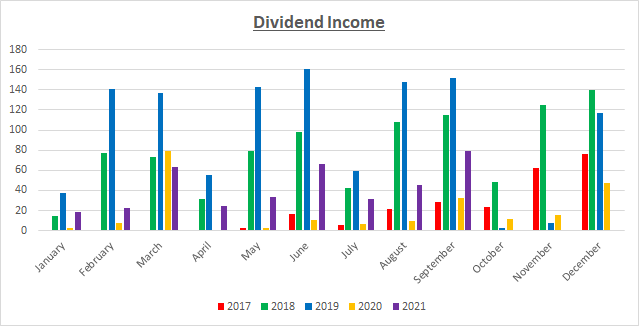

Here is a graphical representation of the dividends earned in September in relation to the dividends earned in previous years:

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | 2021 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | $18.18 | 718.92% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | $22.94 | 206.28% |

| March | $0.00 | $72.93 | $136.45 | $78.68 | $63.35 | -19.48% |

| April | $0.41 | $31.47 | $55.39 | $0.33 | $24.85 | 7430.30% |

| May | $2.85 | $79.33 | $142.69 | $2.23 | $33.69 | 1410.76% |

| June | $16.89 | $98.51 | $160.47 | $10.29 | $66.08 | 542.18% |

| July | $5.99 | $42.32 | $59.68 | $6.67 | $31.22 | 368.07% |

| August | $21.95 | $108.44 | $147.73 | $9.72 | $45.79 | 371.09% |

| September | $28.72 | $111.15 | $151.66 | $30.19 | $78.88 | 161.28% |

| October | $23.21 | $48.09 | $3.00 | $11.46 | ||

| November | $62.11 | $124.92 | $7.18 | $15.84 | ||

| December | $76.51 | $140.24 | $116.51 | $47.57 |

161.28% is a healthy increase from 2019! It seems apparent that I’ve moved consistently into positive territory. I have rebuilt my portfolio quite nicely although admittedly quite slowly. Of course, now that I’ve sold some of my stocks, I have to work harder to rebuild my portfolio. Every little bit counts, and I will continue to rebuild one dividend at a time. It’s only a matter of time before the dividends earned in September will exceed that of 2019!

Forward Annual Dividends

At the time of this writing, the forward annual dividends is $267.75. A month ago, my forward annual dividends was $640.09. This represents a 58% DECREASE from the previous month. I suppose it could be worse.

I anticipate a slower growth rate for the next couple of months, as I try to figure out how to deal with increased expenses. Additionally, because I bought a beach condo, I’ve paused the minimum contribution to my dividend portfolio. So, as the saying goes, the struggle is real.

Finally, the dividend tracker has been updated.

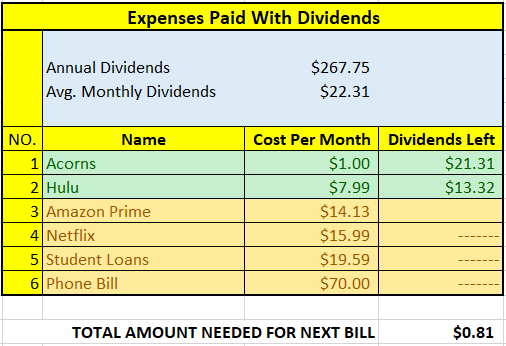

What Expenses Would Dividends Cover?

Here, I visualize what expenses my annual dividend income could pay for. This is one of my favorite parts of pursuing dividend growth investing.

$267.75 per year is $22.31 dividends per month, on average. At present, I earn enough in dividends to cover Acorns and Hulu Plus with Amazon Prime in sight. The next bill I am targeting is Amazon Prime and then Netflix. Amazon Prime is $14.13 per month. The total amount needed until I can pay the next bill is $0.81 in dividends. I hope to be able to cover this bill by the end of the year.

The following is a list of expenses I am targeting:

Conclusion

Dividend growth investing is a long-term strategy. My plan is to stick with this strategy for the long-term, even though I liquidated part of my portfolio again to buy the beach condo!!! Wish me luck. Life has been crazy recently, but I finally feel I’m in a good place. We’ll just have to see how long that lasts.

How was September for you? Did you break any records? Let me know your thoughts by commenting below.

Pingback: Dividend Income From You The Bloggers - September 2021!

Thanks as always for including me in the reports. It’s always exciting to see how well the community does. I aim to ensure that the comeback is indeed better than the set-back.

Pingback: Dividend Income From You The Bloggers – September 2021! – Dividend Growth Investors Daily